- Moorhead scholarship recipients

M STATE FOUNDATION AWARDS 105 STUDENT SCHOLARSHIPS

MOORHEAD – More than $91,000 was recently awarded through 105 student scholarships at M State. Three separate scholarship award ceremonies were held at the college’s Detroit Lakes, Moorhead and Wadena campuses on Nov. 28, 29 and 30 in celebration of the fall 2023 M State Foundation and Alumni scholarship recipients.

To be selected for a scholarship through M State Foundation and Alumni, students must be registered for nine or more credits and have a minimum grade point average of 2.0. In addition, the foundation has a review team that ranks recipients in order of greatest need, as determined by their scholarship application information.

“We are so proud of the students of M State for their commitment and dedication, and grateful for the generous support of our scholarship donors,” says Shannon Britten, Associate Director of Advancement and Development for the foundation. “These scholarships help pave the way for students to pursue their dreams.”

M State Foundation and Alumni provides financial support to the college’s Detroit Lakes, Moorhead and Wadena campuses, helping to ensure a success story for every M State student. It is one of two separate foundations that work on behalf of M State and its students: The other, Fergus Area College Foundation, supports the Fergus Falls campus.

FORM 1099-MISC BEING ISSUED FOR DIRECT TAX REBATE PAYMENT RECIPIENTS

The Minnesota Department of Revenue will mail federal Form 1099-MISC to all Minnesota Direct Tax Rebate recipients to use when filing their 2023 federal income tax returns in 2024. Recipients should expect their Form 1099-MISC by the end of January.

Why is Revenue sending these forms?

While Direct Tax Rebates are not taxable for Minnesota purposes, the IRS has determined that they are taxable on the federal return.

Recipients will report the Form 1099-MISC amount on line 8 of federal Schedule 1 (Form 1040).

Is the payment taxable on Minnesota returns?

No. If recipients include this payment in their federal adjusted gross income, they should subtract it from their Minnesota taxable income on line 33 of their Schedule M1M, Income Additions and Subtractions.

Recipients who file Form M1PR, Homestead Credit Refund (for Homeowners) and Renter’s Property Tax Refund, should subtract the payment from their household income on line 10 of the form.

What if I have questions about the Direct Tax Rebate?

For general questions and information about the payment, visit our Direct Tax Rebate Payments webpage.

For questions about filing your federal return and reporting Form 1099-MISC income, call the IRS at 1-800-829-1040.

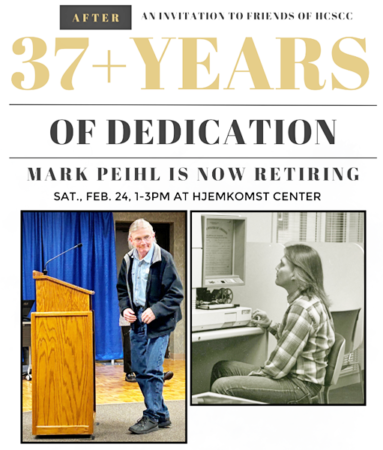

MARK PEIHL RETIRES IN FEBRUARY

MOORHEAD – Longtime Clay County Archivist Mark Peihl will be retiring in February of next year. Although he had been scheduled to retire 12/31, he was asked to stay on through the transition to a new archivist until the end of Feb. His retirement party that had been scheduled for Dec. 16 has been rescheduled to Sat. Feb. 24 at 1pm at the Hjemkomst Center.

BETHANY RETIREMENT LIVING AND 4 LUV OF DOG RESCUE ANNOUNCE PARTNERSHIP

FARGO – Bethany Retirement Living, a leading provider of senior living in the FM area, is excited to announce a new partnership with 4 Luv of Dog Rescue, a local non-profit dedicated to rescuing and rehoming dogs in need. Together, they are launching the “Seniors 4 Seniors” program in 2024, kicking off in December, a unique initiative that specifically highlights the inclusion of older dogs and older humans.

Starting in January 2024, Bethany Retirement Living and 4 Luv of Dog Rescue will collaborate to bring the healing power of the human-animal bond to senior residents, featuring both older dogs and older humans. Each month, a carefully selected and trained rescue dog, with a focus on older dogs, will visit Bethany’s community, providing companionship and emotional support to the residents.

Research has shown that interactions with animals can have profound positive effects on the physical and mental well-being of seniors. The Seniors 4 Seniors program aims to enhance the quality of life for Bethany’s residents, and everyone for that matter, by fostering connections with these loving canine companions — specifically tailoring the program to feature both older dogs and older humans. The partnership aligns with both organizations’ commitment to enhancing the lives of individuals in the community.

Grant Richardson, Senior Executive – Development & Community Relations of Bethany Retirement Living: “We are thrilled to partner with 4 Luv of Dog Rescue for this innovative program. The joy that animals bring to our lives is immeasurable, and we are excited to share that joy with our residents through the Seniors 4 Seniors initiative.”

Katie Paseka, Volunteer with 4 Luv of Dog Rescue: “We are so excited to be partnering with Bethany Retirement Living in this new and creative adventure. The Seniors 4 Seniors program will bring people and dogs together, in hopes that some of our dogs find their forever homes. If we can also brighten the days of Bethany’s residents and staff, even better!”

4 Luv of Dog Rescue will carefully select dogs suitable for seniors, ensuring they bring comfort and joy to the residents.

Each month, a new dog will visit Bethany Retirement Living for scheduled interactions with residents.

Residents will have the opportunity to engage with the dogs, fostering a sense of companionship and emotional well-being.

There will be information about both Bethany Retirement Living as well as 4Luv of Dog rescue available at that time.

Christmas Eve (observed) and Christmas Day Moorhead

holiday service changes

City of Moorhead offices will be closed for Christmas Eve (observed) on Friday, December 22, and Christmas Day on Monday, December 25. They will reopen on Tuesday, December 26. Important service impacts:

Garbage/Recycling: Friday, December 22 garbage/recycling will be picked up on Thursday, December 21; there will be no garbage/recycling pickup on Friday, December 22.

Monday, December 25 garbage/recycling routes will be collected on Tuesday, December 26. All other routes the week after Christmas will be collected on the regularly scheduled day.

Please be aware the changes may cause early or delayed collection; set your trash out by 4 am to ensure it is collected.

MATBUS: MAT Paratransit service will end at 5:15 pm on Sunday, December 24. There will be no MATBUS or MAT Paratransit service and the Ground Transportation Center will be closed on Monday, December 25. All services will resume December 26.